Template (Download in MS Word, Google Docs, PDF) & Example (Copy & Paste)

John Smith

Chief Financial Officer

Smith Enterprises

789 Oak Street

Springfield, IL 62701

john.smith@example.com

(555) 789-1234

June 30, 2024

Mr. Michael Johnson

Tax Manager

Smith Enterprises

789 Oak Street

Springfield, IL 62701

Dear Mr. Johnson,

I am writing to confirm the status of Smith Holdings LLC as a disregarded entity for tax purposes, effective June 1, 2024. This status means that Smith Holdings LLC is not treated as a separate entity from its owner for federal tax purposes.

As discussed in our recent tax filings and documentation, Smith Holdings LLC will continue to operate under this classification. Should you require any further details or clarification regarding this matter, please do not hesitate to reach out to me directly.

Thank you for your attention to this confirmation.

Sincerely,

John Smith

Chief Financial Officer

Smith Enterprises

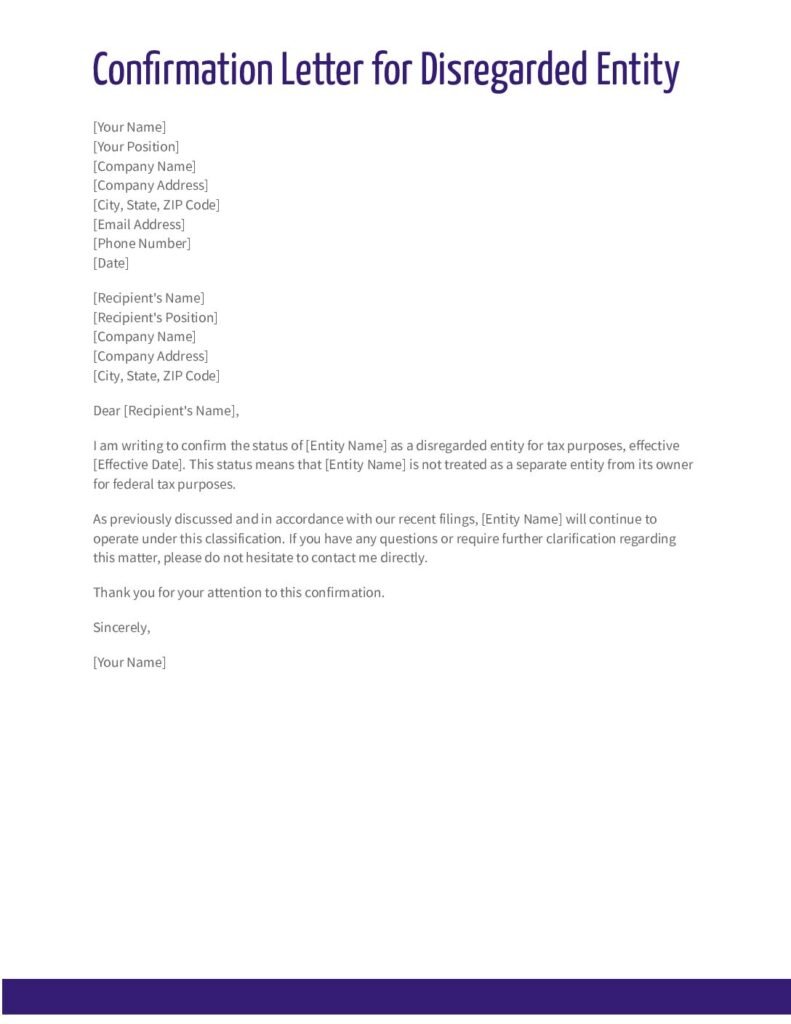

A Confirmation Letter for a Disregarded Entity is a formal document that acknowledges the classification of a business entity, typically an LLC, as a disregarded entity for tax purposes. This letter is usually sent by the owner or a legal representative to confirm that the entity will be treated as a disregarded entity, meaning that it will not be recognized as separate from its owner for federal tax purposes. The letter outlines the specific details, such as the entity’s name, the owner’s name, and the effective date of the disregarded status. It may also include a reference to the relevant IRS classification rules and any pertinent tax identification numbers. The purpose of this letter is to ensure that all parties involved, including tax authorities and business partners, are informed of the entity’s tax status, thereby avoiding any potential confusion or misreporting. This document is crucial for maintaining accurate tax records and ensuring compliance with federal tax regulations.